I was recently reading an article about a company featured in Fast Company magazine, who has become very successful with a very simple business model: give customers only what they want.

You might be thinking: “well, that’s what every company does.”

But, the 2013 Chaos Manifesto published by The Standish Group presents a very different story. They report that only 20% of any given product’s features are used often, 50% are hardly ever used, and the remaining 30% are used infrequently. Yikes. That literally means that about 70% of the functionality most companies are spending their money to discover and deliver to the market are not really even being used—and by extension, one can assume, needed.

As a consumer I know I can relate to that—I’m pretty sure my phone does much more than I ever use, know how to use, or care to use. You can probably relate.

As a consumer I know I can relate to that—I’m pretty sure my phone does much more than I ever use, know how to use, or care to use. You can probably relate.

But this company I was reading about in Fast Company, they didn’t really seem to have that issue because either a) they did not build anything not explicitly asked for by the market, or b) they quickly tossed any products that were not being used and moved onto research what else to develop.

Now maybe that in and of itself is not that interesting, but what I did find interesting was they approach they used to do it. And how easily they seemed to have done it—as well as how cheaply.

Some organizations spend thousands of dollars a year on market-sensing activities trying to figure out what the right product and features are to build—focus groups, surveys, market research service companies, customer visits, interviews, and the list goes on. Other companies just start firing off every requested feature to development in a constant battle against the fire of the market. And still other companies don’t even approach the market and make the decisions for them what they want. Sometimes these methods work, but many times, as evidenced by the Standish report, they do not. And all of them can be very expensive.

The key to this company’s success I was reading about? Nothing fancy really – they simply read through product reviews on Amazon, and then filled in the identified gaps with products that meet what the market is looking for. And that’s it —they have a team dedicated to browsing the comments and looking for comments such as ‘This product was okay but I wish it had…”, or “This is almost what I need, but I also need it to do…”. Then they just fill the gap by producing that product—they have literally become a million dollar company just by doing this one simple market sensing activity.

Which I find interesting for a few reasons: 1) because it seems so logical, 2) because it seems while it can take time and effort to do, it would be a relatively straightforward and accurate means of market sensing, and 3) because it removes the direct interaction between company and consumer and simply uses the market’s naturally occurring conversations to derive what they want. The company was no longer leading the conversation via a focus group, or an interview, or a survey—but they were going where the conversations around what the market wants occur in a very natural way.

And that last point is what I find most interesting.

It also reminded me of a webinar I attended a couple years ago by Keith Goffin (author of “Identifying Customers Hidden Needs”) that talked about this very concept—that even when we ask the market what the need is, we cannot really get accurate answers. And that what the market really wants, is often hiding beneath the surface, in their subconscious.

To see what I mean, I am going to run through a method covered in the webinar called the ‘repertory grid’ technique.

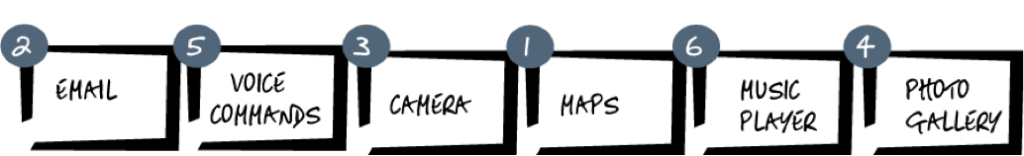

So, pretend you are my target market and I am looking for ways to improve the phone you currently have—I ask you to name any six features of that phone, and then put them into numbered cards as such:

And then maybe I ask you the question:

“How does feature #5 (voice command) differ from features #2 and #1?”

And you may reply something such as: “It’s easier to access than the others,” or, “It’s more fun to use than the others.” Or if you really hate one of the features you may reply something like “at least it works.”

And then I would continue on to ask you a series of similar questions all comparing and contrasting the features. And from your responses I would come up with a list of constructs to compare the other features against.

So for example, constructs from the above examples might be:

- “Easy to access”

- “Fun to use”

- “Makes me more productive”

The constructs are all the natural ways that you have come up with describing these features.

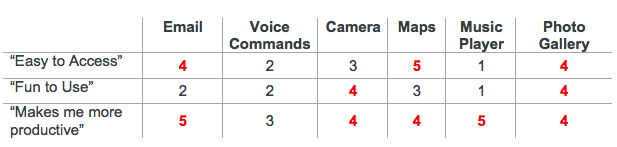

I would then take those constructs and ask you to rate them for each feature in a grid, which may look something like this:

And ask you to rate each one on a scale of 1 to 5 – so for example: “On a scale of 1 to 5, with 1 being really easy to access and 5 being incredibly frustrating, how would you rate the Email feature? How would you rate the Maps feature?” and so on.

In the end, you may have a grid similar to this:

Then, as the product manager or person responsible for discovering how a product can be improved, you can start to pull out all the highly rated scores against the features and look for improvements.

In the above case, there are quite a few 4’s and 5’s, meaning there is probably a lot of room for improvement.

So what is the biggest difference between finding out what a customer needs this way versus just asking them what features they want in a phone or how it can be improved? Well, the biggest difference is the entire conversation is driven for the most part, by the customers themselves, using their own words and without any leading. Many times when we do direct interviews, or focus groups, we are asking specific questions in a specific way—and it can limit how a customer expresses what they need in a product. When we give customers the ability to naturally express their thoughts on a product, what we get as a result is much more valuable input as to what they are looking for, and they often come up with constructs or descriptions that we as a company never would have thought to use were we coming up with questions for an interview or focus group.

There is value in letting the customer drive the conversation—whether it be through the repertory grid approach outlined above, or by going to a place where the conversation naturally occurs itself, such as Amazon product reviews. More times than not, this approach can give companies a much better shot at really developing features the market wants, features they need, and ultimately features they will use.

[cta id=”7452″]

Kelly, I love the way this is structured and written. But – where is the line between customer needs and wants here?